In November 2009 the Board issued the chapters of IFRS 9 relating to the classification and measurement of financial assets. In October 2010 the Board added the requirements related to the …

Note: IFRS 9 does not contain the classification for available-for-sale financial assets. Carrying amount is the amount at which an asset is presented in the statement of financial position. Cash refers to …

However, in some cases, IFRS 10, IAS 27 or IAS 28 require or permit an entity to account for an interest in a subsidiary, associate or joint venture in accordance with some or all of the requirements of this …

- [PDF]

IFRS 9

This Standard aims at improving the comparability and facilitating an understan-ding of financial statements by presenting more relevant and useful informaion to investors and other users. IFRS 9 …

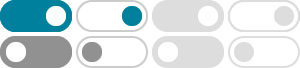

IFRS 9 replaces the rules based model in IAS 39 with an approach which bases classification and measurement on the business model of an entity, and on the cash flows associated with each …

International Financial Reporting Standard 9Financial Instruments - IFRS

IFRS 9 should be read in the context of its objective and the Basis for Conclusions, the Preface to IFRS Accounting Standards and the Conceptual Framework for Financial Reporting.

IFRS 9’s objective is to establish principles for the financial reporting of financial instruments that will present relevant and useful information to users of financial statements for their assessment of …

Paragraphs describing the IASB’s considerations in reaching its own conclusions on IFRS 9 are numbered with the prefix BC. This Basis for Conclusions summarises the considerations of the …

IFRS 9 provides guidance on how to account for the forward element of a forward contract and the approach applied is consistent with the approach taken in respect of the time value of options.

The issue of IFRS 9, Financial Instruments is part of the project to replace IAS 39, Financial Instruments – Recognition and Measurement.